PFRDA has taken various initiatives for the expansion of outreach and ease the operations under APY. Online facility to view Statement of Account and the ePRAN card was enabled for the easy access of account of APY subscribers, going ahead mobile applications for empowering the subscribers to view transactions and other details of their APY account was introduced. For the Convenience of the subscriber and promoting the digital initiatives of GOI, PFRDA introduced the online registration facility through eNPS Channel by login to a website www.enps.nsdl.com without any requirement of the physical document.

Now, the subscribers’ base under the Atal Pension Yojana (APY) has reached more than 80 Lakhs and growing at a good pace. PFRDA appreciates the efforts taken out by the APY Service Providers (Banks/DoP) for their contribution towards making India a Pensioned Society. It notable that last two financial years achievement under APY has been achieved in the month of December itself.

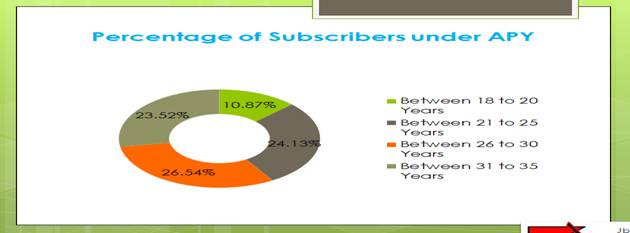

APY became operational from 1st June, 015 and is available to all citizens of India in the age group of 18-40 years. Under the scheme, a subscriber would receive a minimum guaranteed pension of Rs.1000 to Rs.5000 per month, depending upon his contribution, from the age of 60 years. The same pension would be paid to the spouse of the subscriber and on the demise of both the subscriber and spouse, the accumulated pension wealth is returned to the nominee.

The APY Scheme follows the same investment pattern as applicable to the NPS contribution of Central Govt employees. During the year 2016-17, it has earned a return of 13.91%.

At present 233 Banks and Department of Post are involved with the implementation of the scheme. Besides the branches of the banks and CBS enabled offices of India Post, quite a few banks are sourcing subscribers through their internet banking portals in a paperless environment. Now APY can also be opened through a complete digital channel through eNPS platform. Currently 15 Banks are offering registration services through eNPS channel including State Bank of India(SBI). A subscriber can view and print the ePRAN card and Statement of Transactions. Further, the subscriber can register complaints/ grievance by providing his/ her PRAN details on https://npslite-nsdl.com/CRAlite/grievanceSub.do.

The highest contributing State is Uttar Pradesh with 11.41 APY account followed by Bihar & Tamil Nadu.8.87 lakh & 6.60lLakh subscribers respectively.

DSM/KA